Insurance market development agency to be set up in Uzbekistan

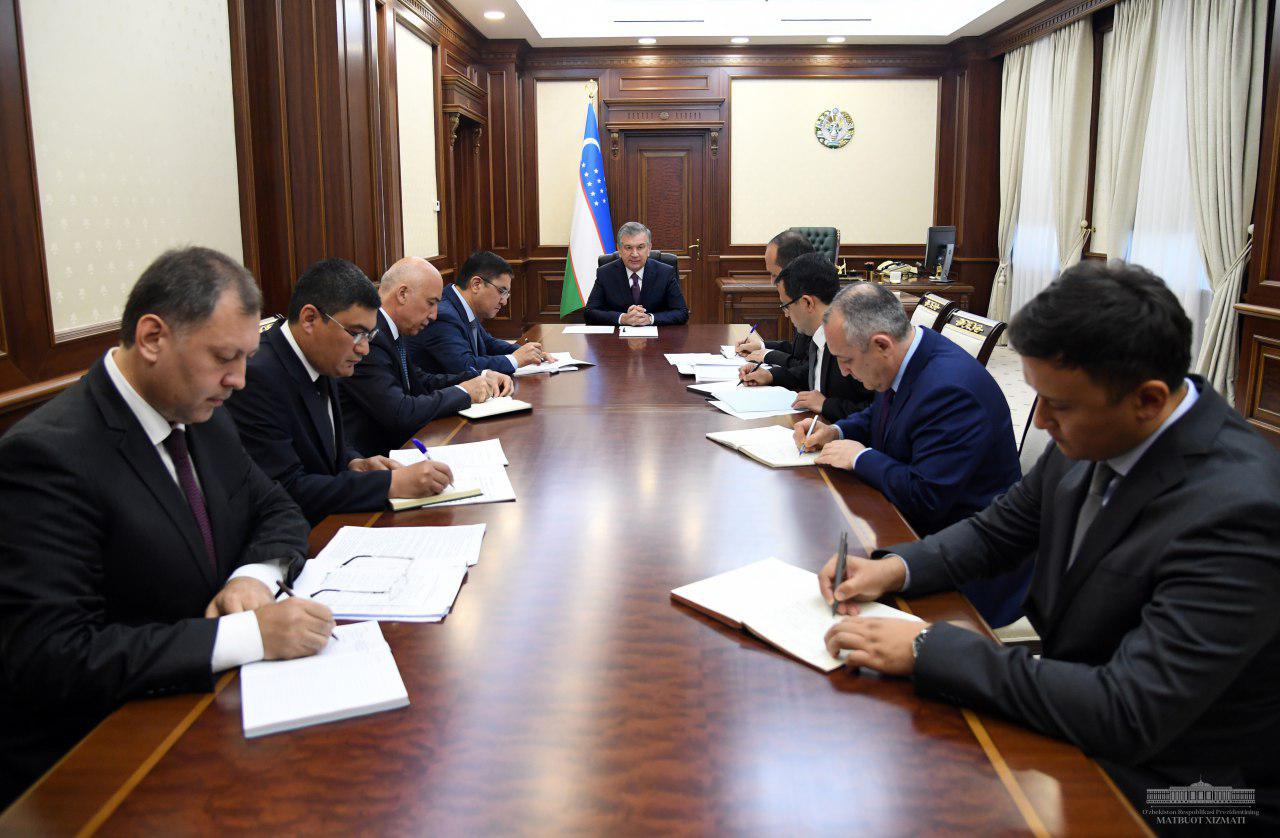

President Shavkat Mirziyoyev held a meeting on July 10 to discuss the state of development of the insurance market and its prospects.

Insurance services are one of the means of protecting the economy from all sorts of financial risks. However, such services in Uzbekistan’s financial market have yet to attain significance.

Over the past six months of this year, the volume of insurance premiums collected by the organizations in the sector grew 1.5 times compared to the same period last year. But in terms of per capita indicator, each person has had 50 thousand sums of insurance premiums.

The share of this sector in the gross domestic product of our country reached only 0.4 percent. For comparison, this figure is 11 percent in South Korea, 6 percent in Germany, 1.5% in Russia.

One of the causes of problems in the field is the low attractiveness of insurance services. Thus, for the past six months insurance premiums were collected in total for 887 billion soums, and insurance compensations reimbursed to customers for the same period amounted to only 11 percent of this amount. In the world, this figure averages 50-60 percent.

The meeting participants discussed the radical reforming of the State Inspectorate for Insurance Supervision under the Ministry of Finance with an eye to contemporary requirements.

“The sector needs not a controlling body, but one that would introduce advanced latest standards, create a truly competitive environment for all participants, develop the insurance market,” Shavkat Mirziyoyev insisted.

The head of our state proposed to liquidate the Inspectorate and establish Agency for Insurance Market Development. Responsible officials were instructed to devise a strategy for the medium and long-term development of the insurance industry, to double the volume of insurance premiums per capita and triple the share of the sector in the country’s GDP by 2022.

The President maintained that the confidence of the population and entrepreneurs in insurance be boosted. The Ministry of Finance and the Antimonopoly Committee were tasked with reducing the time and list of documents for examining insurance claims, introducing a system for a fair assessment of an insured event and for prompt disbursement of payments.

Shavkat Mirziyoyev pointed out the need to expand mechanisms to support the investment activities of insurance organizations. In particular, the objectives defined included those for stimulating leasing by insurance companies and improving the leasing operations taxation system.

The importance of insurance coverage of industries was emphasized. The Ministry of Finance and the Ministry of Investment and Foreign Trade were given directives for the introduction of subsidy mechanisms for a part of costs of insurance of agricultural exports.

Specific objectives were identified to ensure that Uzbek insurance companies enter the international financial market, introduce advanced corporate governance systems and obtain international ratings.

Individual attention was paid to training modern personnel in the field of insurance, qualification raising and advanced training of specialists in prestigious educational institutions and leading companies abroad.

Speaking about the introduction of compulsory health insurance system, the head of state stressed the need for thorough preparation for the new system and the formation of a minimum social package of medical services.